How To Start A Simple Budget

How To Start A Simple Budget

When you think of making a budget, does panic start to slowly rise? Budgeting can definitely have a bad connotation to it, but if you think about it as a learning tool that helps you become more financially stable, you might give it a second thought. Budgeting is just telling your money where it is going every month instead of it telling you where it is going. When you have a budget set firmly in place (and you follow it correctly), you know exactly how your money is being spent. This causes less financial stress and worry and lets you actually enjoy your money.

If you’ve never started a budget, it may seem like an overwhelming task, but you can actually start a simple budget in five easy steps. Just read below to find out how to get started.

1) Define Your Goals:

Is your goal to pay off debt quickly? Is it just to maintain your current finances? Is it to save for an emergency, special item or trip? Write down all your financial goals for the foreseeable future and put them somewhere where you can see them everyday. This will help keep you on track with your budget. On those days where you feel like you might want to go off track, remember your “why” and stick to it!

2) Define Your Income:

Now that we have your goals down and in place, it’s time to tackle the actual budget. Write down every stream of income your household makes and how often you get paid. Add all of the income streams up and put that total at the top of your budget. Now you know exactly how much money you have to work with every month.

3) Define your fixed expenses:

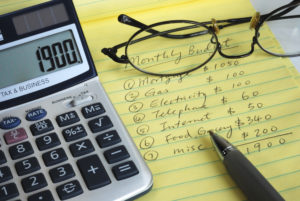

Fixed expenses are those expenses that you absolutely have to pay every month. Usually these expenses are the same amount every time, but sometimes they can vary. These are items like mortgage/rent, utilities, credit card payments, car payments, cable, internet and phone bills. Add all of these monthly payments up and put the total under your income total.

4) Define your discretionary expenses:

Your discretionary expenses are things that change every month. Figure out how much you need to spend on groceries, gas, eating out, gifts, clothing, savings and other items that may change from month to month. Write down all the spending categories you need to have every month, and then put down how much you are willing to budget beside them. Take all those numbers, add them up, and then put the total under the fixed expenses total.

5) Total your budget:

Subtract the fixed and discretionary expenses totals from your monthly income total. The total should equal zero.

If you have a negative number, it’s time to do some tweaking to your budget. Look at your discretionary expenses. Can you budget less in some of those categories to get your budget total to equal zero? This may mean cutting back on coffee runs, eating out or other “fun” things, but in the long run having a financial peace of mind will be worth it.

If you have extra money left over after you have subtracted your expenses from your income, take a look at your goals you defined in step one. Was your goal to save up for something? Great! Put that extra money towards savings. Was one of your goals to pay off debt? Put that extra money into a debt payment to speed along the process. It’s up to you what you do with that extra money, but put it in the budget so that you have a plan for where it goes.

Congratulations! You have made a budget. As you can see, making a budget is really a simple process, and it is a great tool to have in your arsenal. If you have a plan and stick to it daily, you are sure to win with your finances.

« Return to "Blog"